The common stock and additional paid-in capital (APIC) line items are not impacted by anything on the CFS, so we just extend the Year 0 amount of $20m to Year 1. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Liquidity is another significant dimension that cash flow from assets highlights.

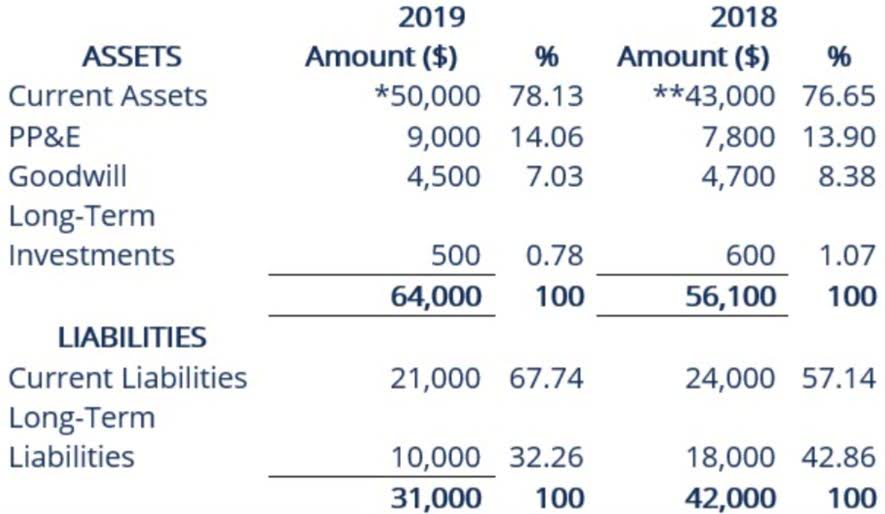

- A balance sheet shows you your business’s assets, liabilities, and owner’s equity at a specific moment in time—typically at the end of a quarter or a year.

- Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities over a pre-defined period.

- Using the direct method, actual cash inflows and outflows are known amounts.

How to Analyze Cash Flows

The beginning cash balance, https://www.instagram.com/bookstime_inc which we get from the Year 0 balance sheet, is equal to $25m, and we add the net change in cash in Year 1 to calculate the ending cash balance. The impact of non-cash add-backs is relatively straightforward, as these have a net positive impact on cash flows (e.g. tax savings). In the second year, you weren’t buying more equipment, so your CAPEX was zero, however, you still had debt to pay.But because we’re talking about UFCF, in this scenario, your debts aren’t part of the equation.Here are the numbers. Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

- While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time.

- The choice of a discount rate can significantly affect the outlook for PBGC.

- This section is important for investors who prefer dividend-paying companies because, as mentioned, it shows cash dividends paid.

- However, because this issue was widely known in the industry, suppliers were less willing to extend terms and wanted to be paid by solar companies faster.

- The operating activities on the CFS include any sources and uses of cash from business activities.

Cash Flow From Operating Activities

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Therefore, it does not evaluate the profitability of a company as it does not consider all costs or revenues. Thus, https://www.bookstime.com/ when a company issues a bond to the public, the company receives cash financing. In contrast, when interest is given to bondholders, the company decreases its cash.

Operating cash flow formula

CBO’s baseline budget projections and estimates for PBGC are made on a cash basis. By law, pension plans must meet funding requirements that are determined by the present value of their liabilities.18 In many cases, however, the costs to the government are greater than the amount suggested by a plan’s valuation. The discount rates that CBO uses to calculate the actuarial deficit of the combined trust funds are the average rates on all bonds projected to be held by the trust funds until their balances are exhausted.

- Increase in Inventory is recorded as a $30,000 growth in inventory on the balance sheet.

- This is because earnings and EPS remove non-cash items from the income statement.

- Net cash flow is a simple but powerful metric that provides a comprehensive picture of your business’s financial health.

- When you tap your line of credit, get a loan, or bring on a new investor, you receive cash in your accounts.

- With the indirect method, cash flow is calculated by adjusting net income by adding or subtracting differences resulting from non-cash transactions.

Structure of the Cash Flow Statement

Along with this, it purchased $5 billion in investments and spent $1 billion on acquisitions. The company also realized a positive inflow of $3 billion from the sale of investments. To calculate the cash flow from investing activities, the sum of these items would be added together, to arrive at the annual figure of -$33 billion. As with any financial statement analysis, it’s best to analyze the cash flow statement in tandem with the balance sheet and income statement to get a complete picture of a company’s financial health. The net cash flows generated from investing activities were $3.71 billion for the twelve months ending Sept. 30, 2023.

Operating Cash Flow Margin

It might be labeled as “ending cash balance” or “net change in cash account.” Cash flow is also considered the net cash amounts from each of the three sections (operations, investing, financing). Other expenditures that generate cash outflows could include business acquisitions and purchasing investment securities. Cash flow from investing includes the cash used to buy long-term assets. This can include both operating necessities and investments that don’t impact day-to-day operations. Unlike the latter, operating cash flow covers unplanned expenses, earnings, and investments that can affect your daily business activities. Twenty-nine percent of small businesses fail because they run out of money.

For some industries, investors consider dividend payments as necessary cash outlays similar to capital expenditures. Though cash flow analysis can how to calculate cash flow from assets involve several ratios, certain key indicators are essential for evaluating the quality of a company’s cash flow. This section is important for investors who prefer dividend-paying companies because, as mentioned, it shows cash dividends paid.